I called my trip the Road to Financial Wellness, a grassroots and social-media experiment to turn local money discussions into a national conversation on financial well being.

After my backpacking trip around the world in 2012, I realized I was able to live my dream lifestyle because I understood and improved my relationship with money.

I used the term "money mindfulness," which means being in the moment and fully aware of all the facts — financially and emotionally — to make better financial decisions. I've learned the importance of applying financial knowledge to help live your dream lifestyle.

I wanted to share this with the world — or at least, this summer, with the US.

My team of four participated in panel discussions; explored large cities and small towns; spoke with people at festivals and local coffee shops; and held events at churches, restaurants, barbecue joints, bars, colleges, and credit-union locations.

I had a mission, and that was to motivate and break the social taboo around money. I began that conversation by sharing these 11 money lessons with over 8,000 people.

The Phroogal team (left to right: Justin Strickland, Yaroslav Tashak, Larry Solha, Juliana Anselmini, and Jason Vitug) on the road.

1. Take advice from people who are living the life you want to live.

Consider their knowledge as valuable information to make better financial decisions. For example, you may need to ask yourself why you're taking investing advice from a peer who isn't a successful investor.

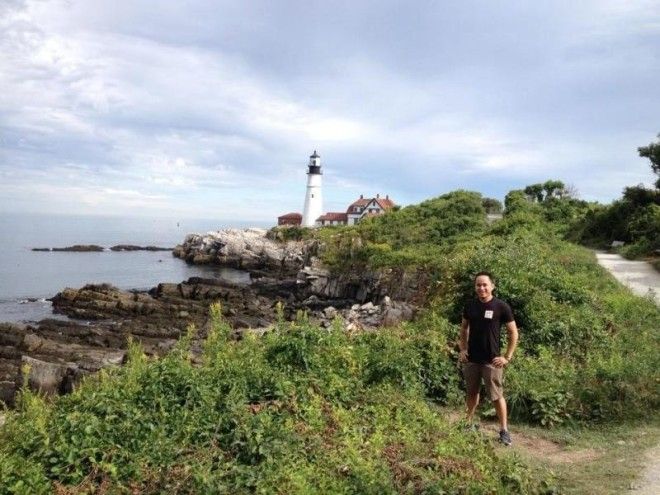

Vitug at Portland Head Light, Portland, Maine.

2. Have a lifestyle goal, not just a financial goal.

A lifestyle is how you live, and financial goals are specific to things that revolve around money. A lifestyle goal is the "why" behind all the hard work and reasoning behind those financial goals. By articulating the life you want to live, you'll learn to create financial goals and make better financial decisions that fulfill that lifestyle.

Vitug at the Bean in Chicago, Illinois (pit stop 13).

3. Be mindful of the financial conversations you're having and not having.

We learn our financial habits from our family, friends, and coworkers and through marketing messages. Although we may not talk about our financial situation openly, we are having these conversations with the clothes we wear, the homes we live in, the cars we drive, and the phones we upgrade.

It's important to be mindful of these conversations because they influence our credit decisions, banking relationships, and spending.

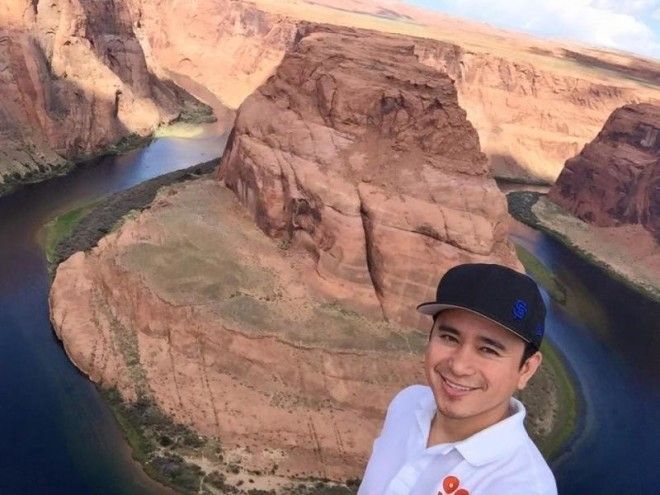

Vitug at Horseshoe Bend In Page, Arizona.

4. Wealth isn't measured by how much you spend, but by how much you've saved.

Pay yourself first and be purposeful with your savings strategy. We work for a paycheck to afford things, whether we decide to spend the money today or in our retirement years. Investing in growing your wealth enables you to retire earlier and pursue your dreams sooner.

Vitug at the Sutro Baths in San Francisco, California (pit stop 29).

5. Beware of lifestyle inflation.

Without awareness of how you spend, you'll find you're spending $80,000 at the same rate you spent a $40,000 paycheck. Lifestyle inflation can prevent you from saving money and building wealth. Are you telling yourself you'll save with the next raise or the new job? Chances are something will come up that'll keep you from saving, so start today.

Vitug in Atlanta, Georgia (pit stop 10).

6. Live your dreams, not someone else's.

Keeping up with the Joneses is spending your hard-earned money to live another person's dream. Financial awareness is spending your hard-earned cash on purchases that add value to your life.

Vitug in Pike's Place Market in Seattle, Washington (pit stop 25).

7. The purchase of goods and experiences are the same.

Research finds that money spent on experiences makes people happier than money spent on goods. That may be the case for other people, but if goods make you happy, that's where you should spend. Whether you decide to spend your paycheck on expensive clothes or a backpacking trip around the world, spend on what matters most to you.

Vitug begins a hike to Angel's Landing at Zion National Park.

8. Cutting expenses is more powerful than increasing income.

It's great to make more, but if you're unable to save more, then you're not improving your financial situation. It's also easier to reduce expenses than increase income. Additionally, reducing expenses have a double effect of lowering your required monthly payments and lowering the amount needed in the future.

Vitug at 12,005 feet above sea level at Rocky Mountain National Park.

9. Prioritize debt repayment.

Debt reserves your future time for work rather than fun. It's important to understand that a reliance on credit to finance your lifestyle can lead to debt. Remove the debt ball and chain and make extra payments to get rid of your debt as soon as you can.

Vitug in Santa Monica on Day 31, one day after completing the Road to Financial Wellness.

10. Credit isn't the problem.

Credit has a bad reputation, but it has allowed many to make wise financial decisions when it comes to housing, transportation, and education. As long as you make smart choices with credit, it can help you achieve the lifestyle you want.

Don't spend beyond your ability to repay used credit early. Avoid turning credit into longterm debt. Think of credit as a tool that enables you to invest in your future instead of indebted to a new living-room set.

Vitug at Liberty State Park in Jersey City, New Jersey, across the river from Lower Manhattan.

11. Money does buy happiness.

Don't be fooled because money can provide for basic needs such as housing and food. But happiness isn't about the dollars in your bank account or the size of your home, the luxuriousness of your car, or the vacations you can afford. Happiness is what those dollars represent: realized dreams.

Jason Vitug is an author, a speaker, a financial motivator, a lifestyle engineer, and a first-time entrepreneur as founder and CEO of Phroogal, a financial education startup and lifestyle brand. Vitug left his senior executive job in 2012 and backpacked around the world to search for his next career move, but came home to define his purpose to democratize financial knowledge and empower a generation to live their dream lifestyles.