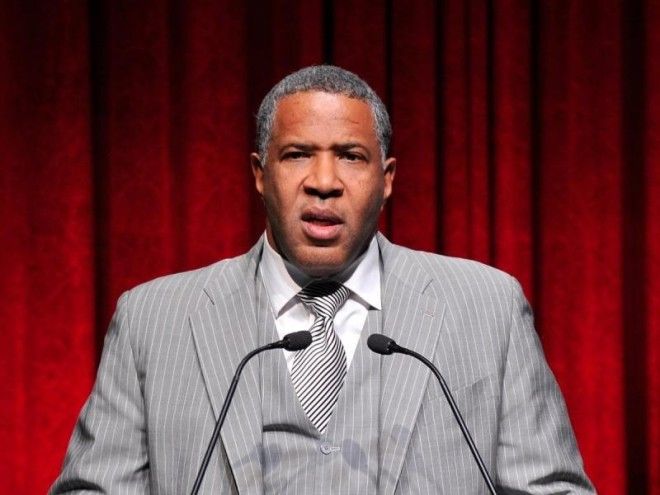

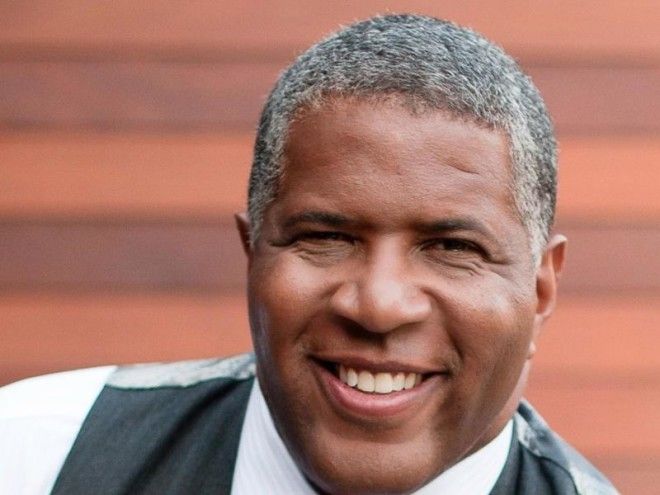

With a net worth of $2.5 billion, he's ranked No. 268 on Forbes' list of wealthiest Americans.

That puts Smith ahead of early Facebook investor Jim Breyer, who has a net worth of about $2.4 billion, and on par with private equity veteran and Philadelphia 76ers co-owner Josh Harris, who has earned $2.5 billion to date.

He also displaced Michael Jordan, becoming the second-richest African-American in the US — behind Oprah Winfrey.

It's the latest accomplishment in a stellar 12 months for the leader of one of Silicon Valley's budding software and technology investors.

Last October, Smith and Vista closed a fund nearing $6 billion, the firm's biggest ever.

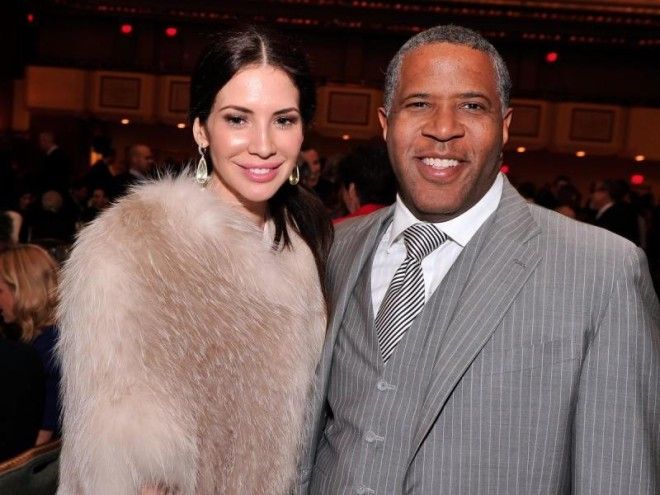

He also got hitched to Hope Dworaczyk, mother of his young son, in a wedding that can only be described as epic.

Check out scenes from the life of one of private equity's rising stars:

He faced an uphill battle in Silicon Valley from early on

Smith gave the commencement speech at American University's 2015 graduation, where he spoke about his earliest attempts to get work in Silicon Valley while he was still in high school.

"I dug up the phone number for Bell Labs to ask about summer internships. They said I could apply if I were a junior or senior in college. I said that was fantastic, because, while I was only a junior in high school, I was getting A’s in computer science and my advanced math courses, so it was like I was in college. Much to my dismay, they disagreed."

But he was persistent and eventually got his way.

"I called back every day for two weeks straight. The HR director stopped taking the calls after the second day but … I left a message with my phone number. Then I called every Monday for about five months, and every Monday the receptionist chuckled and took a message. I kept at it. To my great surprise, Bell Labs HR Director finally called me back — in June. An intern from MIT hadn’t shown up, and they needed someone fast."

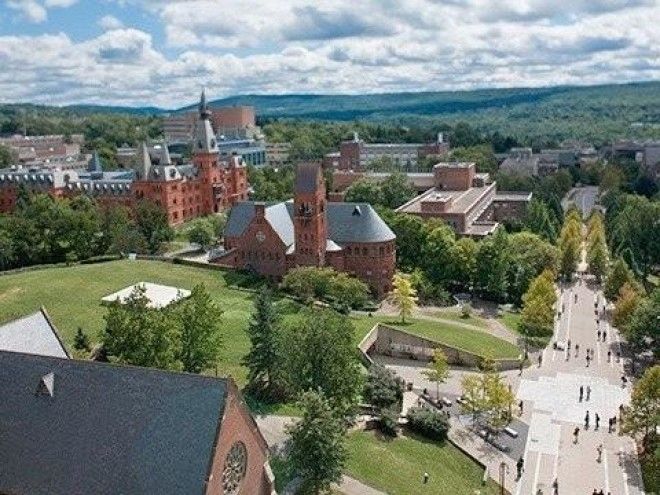

Smith spent years working as an intern at Bell

Smith attended Cornell for undergrad but he never lost touch with Bell Labs. He continued to do work there as an intern during his summer and winter breaks before graduating Cornell with a chemical-engineering degree.

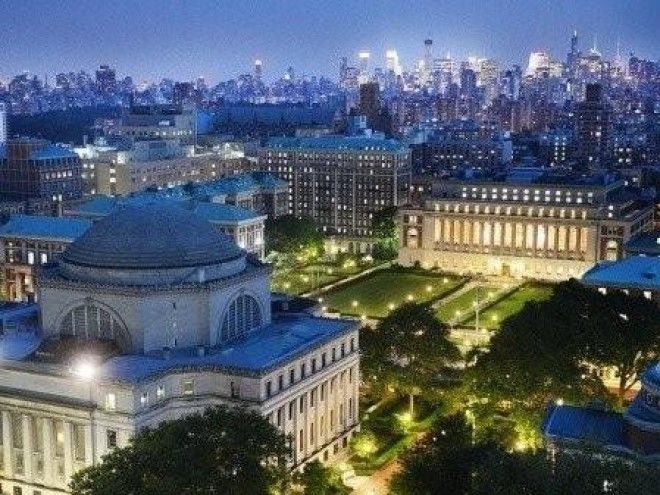

After Cornell, Smith headed to Columbia University

Smith would go on to earn his MBA from Columbia University. Afterward, he headed straight to Wall Street, taking a job at Goldman Sachs. "When I finished business school and decided to join the tumultuous world of investment banking, my family and friends spoke up with concerns about my sanity," he said in his American University commencement speech. Smith would rise to cohead of enterprise systems and storage-investment banking, advising on $50 billion of deals from 1994 to 2000.

Smith launched Vista Equity Partners after leaving Goldman Sachs

Smith left Goldman Sachs, where he worked on tech M&A, in 2000 and launched his own private equity firm. In the 15 years since, Vista Equity Partners has generated outsized returns for investors and grown to nearly $16 billion in assets, according to Forbes. It is considered to be one of private equity's up-and-coming firms.

His former colleagues at the bank thought he was crazy

Vista founder Robert F. Smith speaking at American University's 2015 commencement.

"When I left my post at Goldman Sachs just after we had gone public to set up a private equity firm called Vista Equity Partners … my mentors and colleagues at Goldman thought I had lost it,” he said in his speech earlier this year.

"I was never mad at those folks, in fact I’m grateful for their advice and concern. In their caution, I found my courage. In their doubts, I found my resolve. In their warnings, I found my voice and chartered my own journey."

Smith's investing strategy is to back Silicon Valley's least-known companies

Silicon Valley may be best known for billion-dollar valuations and soaring real-estate prices, but Smith's strategy is practically contrarian: He's investing in software and technology companies that aren't in the least bit flashy. The New York Times recently called Vista's hiring strategy "decidedly unusual" for how it uses tests to whittle down candidate lists.

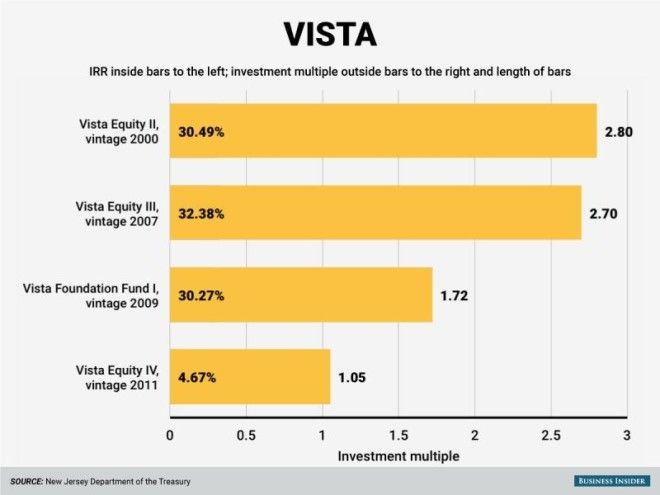

Smith's private equity firm is generating monster returns

Vista Equity funds' performance, regularly returning 30% to investors.

In the years since Vista's founding, the firm has generated bumper returns for investors and gradually increased assets under management. Smith's fund collected nearly $6 billion for its most recent fund, despite only setting out initially to collect less than $4 billion.

Advertising

Smith has the respect of many of his Wall Street peers.

Smith’s strategy — as well as his work ethic — have won him praise on Wall Street. He’s the “antithesis of [Blackstone CEO Steve] Schwarzman,” a tech-industry banker told Business Insider. The banker went on to praise Vista, as well, saying “there is no shortage of PE shops that have succumbed to style creep and/or chasing fleeting trends, but Vista has remained focused on enterprise software and technology."

Another banker told Business Insider that Smith was "one of the smartest men I've ever met."

Smith parties in style

Smith, pictured here with his wife, who he married in a lavish ceremony this summer.

This summer, Smith married Hope Dworaczyk, a former Playboy playmate and mother of his young son. The two celebrated by renting out the Hotel Villa Cimbrone in Italy and putting on a star-studded display that included entertainment from Seal, John Legend, and Bryan McKnight.

And here's a look at the incredible Italian villa the couple rented out for their ceremony

Hotel Villa Cimbrone in Italy

The couple held their wedding at the Hotel Villa Cimbrone in Italy on the Amalfi Coast, shown here.

Smith is a donor to Democrats

Sen. Chuck Schumer (D-New York) speaks to the press after Republican Senator

Ted Cruz (not pictured) held a marathon attack on "Obamacare" at the US Capitol in Washington, September 25, 2013.

Many private equity executives are regular donors to campaigns on both sides of the aisle, and for good cause — this year, there's legitimate concern about how the tax break on which the industry depends will be treated by the incoming administration. Smith is no different: He has donated to Democrats, including Hillary Clinton and New York Sen. Chuck Schumer.

Smith still has the time for some recreational activities

A man is pictured fly-fishing.

Smith also serves as the chairman for the Robert F. Kennedy Center for Justice and Human Rights; he's a member of the Cornell Engineering College Council, and a trustee of the Boys and Girls Clubs of San Francisco. He's also a board member of Carnegie Hall in New York — and, when he finds the time, he's a fly fisherman, according to his bio.

Smith is now the second-richest African-American, behind Oprah

Oprah speaks onstage during the 45th NAACP Image Awards presented by TV One at Pasadena Civic Auditorium on February 22, 2014, in Pasadena, California.

With his arrival at the No. 268 spot on Forbes' list, Smith moves into elite company. He's the second-richest African-American, only trailing Oprah Winfrey after displaced NBA Hall of Famer Michael Jordan in the magazine's rankings.

When he took an investment from Dyal Partners, Neuberger Berman's private equity unit, in Vista, it valued his firm at $4.3 billion. Smith still controls a majority stake in Vista.

Smith said that being African-American in private equity has caused him difficulty: "I know that's the reason certain limited partners don't back us," he told The New York Times.