The official trailer was recently released, and we can hardly wait to see some of Hollywood's biggest names playing the heroes of the financial crisis— Steve Carell as Steve Eisman, Christian Bale as Michael Burry, Ryan Gosling as Greg Lippmann, and Brad Pitt as Ben Hockett.

Like the book, the film chronicles the stories of this group of Wall Street outsiders who accurately predicted the housing crisis and made a fortune betting against subprime-mortgage bonds.

If you haven't read it yet, we recommend that you do. It's full of incredible details. One in particular that stands out is a passage on the observations of former FrontPoint head trader Danny Moses.

Moses, described as the small-picture guy on Steve Eisman's team, claimed he could tell a lot about a guy just by looking at him.

The best place to study Wall Street people was on the morning commute from Connecticut. Moses estimated that 95% of the people on his morning Metro North train worked on Wall Street.

Just by looking at them, he said, he could tell at a glance what their jobs were and where they worked.

If they were on their BlackBerrys, they were probably hedge fund guys, checking their profits and losses in the Asian markets. [Given the book was based on 2008, you can probably swap BlackBerrys then for iPhones today.]

If they slept on the train they were probably sell-side people — brokers, who had no skin in the game.

Anyone carrying a briefcase or a bag was probably not employed on the sell side, as the only reason you'd carry a bag was to haul around brokerage research, and the brokers didn't read their own reports — at least not in their spare time.

Anyone carrying a copy of The New York Times was probably a lawyer or a back-office person or someone who worked in the financial markets without actually being in the markets.

The guys who ran money dressed as if they were going to a Yankees game. Their financial performance was supposed to be all that mattered about them, and so it caused suspicion if they dressed too well.

If you saw a buy-side guy in a suit, it usually meant that he was in trouble, or scheduled to meet with someone who had given him money, or both. Beyond that, it was hard to tell much about a buy-side person from what he was wearing.

The sell side, on the other hand, might as well have been wearing their business cards: The guy in the blazer and khakis was a broker at a second-tier firm;

The guy in the three-thousand-dollar suit and the hair just so was an investment banker at JP Morgan or someplace like that.

The Goldman Sachs, Deutsche Bank, and Merrill Lynch people, who were headed downtown, edged to the front ...

— though when Danny thought about it, few Goldman people actually rode the train anymore. They all had private cars.

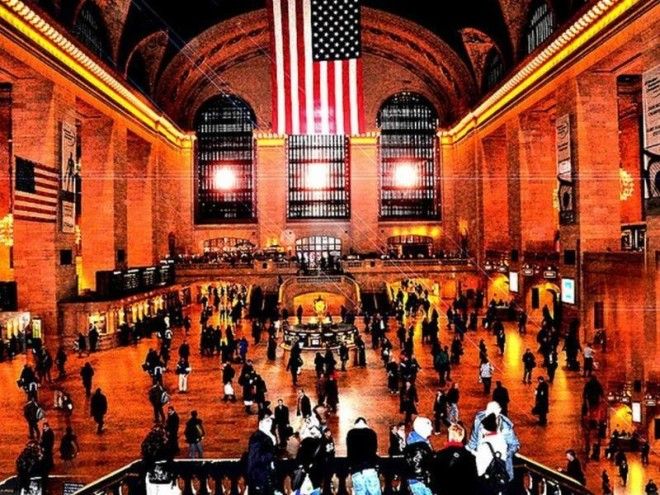

Hedge fund guys worked uptown and so exited Grand Central to the north, where taxis appeared haphazardly and out of nowhere to meet them, like farm trout rising to corn kernels.