RealtyTrac, a real-estate research firm, compiled data from 504 counties in large housing markets across the US. They found that in these markets the cost to rent, as a percentage of median wages, was lower than a monthly home payment about 42% of the time.

We've taken RealtyTrac's data and found the top 15 places you can save big by renting instead of buying.

To broaden the scope a bit, we excluded the giant New York and California markets that dominate the top of RealtyTrac's list (though we've included that data later on as well).

Texas is the most represented state on the list with one-third of the counties. There is only one county on the list, however, in the Midwest.

Find out below which counties have the biggest savings for renters over buyers.

(Note: We've included counties with populations over 300,000 and where savings on buying instead of renting is more than 10% of wages. Additionally, average monthly house cost was computed using an insurance-payment rate of 0.35% of median home value and a property-tax rate of 1.04% of median home value.)

15. Montgomery County, TX

Homes in Montgomery County, TX.

Metro Area: Houston-The Woodlands-Sugar Land, TX

Population: 472,162

Median Weekly Income: $982

Average Monthly Rent: $1,386

Estimated Monthly Mortgage Payment: $1,821

Difference in median income needed to rent instead of buy:10.23%

14. Collier County, FL

Metro Area: Naples-Immokalee-Marco Island, FL

Population: 328,209

Median Weekly Income: $846

Average Monthly Rent: $1,479

Estimated Monthly Mortgage Payment: $1,869

Difference in median income needed to rent instead of buy:10.65%

13. Multnomah County, OR

Metro Area: Portland-Vancouver-Hillsboro, OR-WA

Population: 747,641

Median Weekly Income: $983

Average Monthly Rent: $1,576

Estimated Monthly Mortgage Payment: $2,052

Difference in median income needed to rent instead of buy:11.17%

12. Denton County, TX

Metro Area: Dallas-Fort Worth-Arlington, TX

Population: 687,857

Median Weekly Income: $867

Average Monthly Rent: $1,337

Estimated Monthly Mortgage Payment: $1,790

Difference in median income needed to rent instead of buy:12.06%

11. Charleston County, SC

Apartments in Charleston, SC.

Metro Area:Charleston-North Charleston, SC

Population: 358,736

Median Weekly Income: $1,108

Average Monthly Rent: $1,301

Estimated Monthly Mortgage Payment: $837

Difference in median income needed to rent instead of buy:13.52%

10. Chester County, PA

Metro Area: Philadelphia-Camden-Wilmington, PA-NJ-DE-MD

Population: 503,075

Median Weekly Income: $1,108

Average Monthly Rent: $1,502

Estimated Monthly Mortgage Payment: $1,295

Difference in median income needed to rent instead of buy:13.91%

9. Loudon County, VA

Homes in a neighborhood in Leesburg, VA.

Metro Area: Washington-Arlington-Alexandria, DC-VA-MD-WV

Population: 326,477

Median Weekly Income: $1,108

Average Monthly Rent: $2,144

Estimated Monthly Mortgage Payment: $2,813

Difference in median income needed to rent instead of buy:13.93%

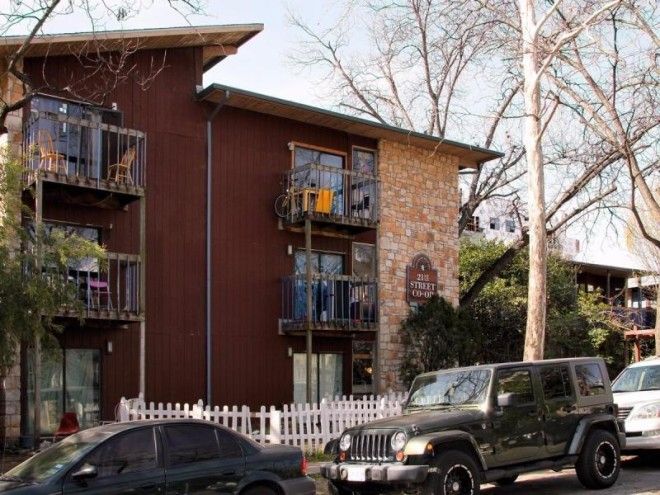

8. Travis County, TX

The 21st Street co-op apartment building in Austin, TX.

Metro Area: Austin-Round Rock, TX

Population: 1,603,248

Median Weekly Income: $1,090

Average Monthly Rent: $1,629

Estimated Monthly Mortgage Payment: $2,301

Difference in median income needed to rent instead of buy:14.22%

7. Fort Bend County, TX

A home in Katy, TX.

Metro Area: Houston-The Woodlands-Sugar Land, TX

Population: 608,939

Median Weekly Income: $945

Average Monthly Rent: $1,386

Estimated Monthly Mortgage Payment: $1,971

Difference in median income needed to rent instead of buy:14.28%

6. Bucks County, PA

Homes along a street in Langhorne Manor, PA.

Metro Area: Philadelphia-Camden-Wilmington, PA-NJ-DE-MD

Population: 625,977

Median Weekly Income: $925

Average Monthly Rent: $1,502

Estimated Monthly Mortgage Payment:

Advertising

Difference in median income needed to rent instead of buy:14.54%

5. Clackamas County, OR

The historic Caroline Bremer House on West Linn, OR.

Metro Area: Portland-Vancouver-Hillsboro, OR-WA

Population: 380,532

Median Weekly Income: $922

Average Monthly Rent: $1,576

Estimated Monthly Mortgage Payment: $2,159

Difference in median income needed to rent instead of buy:14.60%

4. Waukesha County, WI

Houses in the McCall Street Historic District in Waukesha, WI.

Metro Area: Milwaukee-Waukesha-West Allis, WI

Population: 391,200

Median Weekly Income: $1,517

Average Monthly Rent: $1,146

Estimated Monthly Mortgage Payment: $1,751

Difference in median income needed to rent instead of buy:14.72%

3. Collin County, TX

The SB Wyatt House in Plano, TX.

Metro Area: Dallas-Fort Worth-Arlington, TX

Population: 811,308

Median Weekly Income: $1,145

Average Monthly Rent: $1,337

Estimated Monthly Mortgage Payment: $2,078

Difference in median income needed to rent instead of buy:14.92%

2. The District of Columbia

Homes on Logan Circle in Washington, D.C.

Metro Area: Washington-Arlington-Alexandria, DC-VA-MD-WV

Population: 619,371

Median Weekly Income: $1,599

Average Monthly Rent: $2,144

Estimated Monthly Mortgage Payment: $3,207

Difference in median income needed to rent instead of buy:15.33%

1. Fairfax County, VA

A home in Fairfax, VA.

Metro Area: Washington-Arlington-Alexandria, DC-VA-MD-WV

Population:1,101,071

Median Weekly Income: $1,517

Average Monthly Rent: $2,144

Estimated Monthly Mortgage Payment: $3,194

Difference in median income needed to rent instead of buy:15.98%

California and New York

A row of homes in Clinton Hill, Brooklyn.

The top of RealtyTrac's list is monopolized by counties surrounding New York City, San Francisco, Los Angeles, and some other Southern California counties (21 of the top 25 overall to be exact).

In order to broaden the geography a bit we removed them from consideration, but here's a rundown of those counties with over 25% rent-to-buy savings. (Counties listed from most to least savings from renting.) And as always you can check out the full data over at RealtyTrac.

New York County, NY: 75.43% less to rent than buy

Rochester County, NY: 68.89% less to rent than buy

Kings County, NY: 58.87% less to rent than buy

Westchester County, NY: 56.95% less to rent than buy

San Francisco County, CA: 46.61% less to rent than buy

San Mateo, CA: 36.94% less to rent than buy

Alameda, CA: 32.21% less to rent than buy

Orange County, CA: 29.66% less to rent than buy

Bergen County, NJ: 29.11% less to rent than buy

Queens County, NY: 26.18% less to rent than buy

Santa Clara County, CA: 26.03% less to rent than buy

Rockland County, NY: 25.01% less to rent than buy